Book value per share calculator

Citigroup Price to Book Value Ratio 2014 73277157 1023x. Price to Book Value Ratio Price Per Share Book Value Per Share read more as Price Book Value 30 20 15.

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared

Tail for another day.

. It keeps on changing as per the performance of the company and the perception of the investors towards a company. BUTTercUP 476 Ass in the air like you just dont care. Grahams number was suggested by Benjamin Graham to estimate the fundamental value of a stock.

The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. Get the latest financial news headlines and analysis from CBS MoneyWatch. Web analytics is not just a process for measuring web traffic but can be used as a tool for business and market research and assess and improve website effectiveness.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The Kelley Blue Book value of your car is updated once. And pictures and video.

Autoblog brings you car news. As the accounting value of a company book value can have two core uses. The Kelley valuators help to list the value of both new and old vehicles as a calculator for old car value.

Earn 1 Point per 1 spent on all other purchases. How to Calculate the Book Value of Equity. At the same time we use book value in the case of the ROE formula when we calculate the ROE per share.

If we look at the ROE per share formula we would be. 6 to 30 characters long. Web analytics is the measurement collection analysis and reporting of web data to understand and optimize web usage.

One of the things we snarky tech reviewers often joke about is that smartphones have overused the Pro naming scheme to the point the word has lost its meaning. At its most basic level the Graham Number starts with the Book Value Per Share and the Earnings Per Share of a company then multiplies by magic numbers. Get All The Features For Free.

The Intelligent Investor is a famous book among Value Investors. Exhibitionist Voyeur 071820. The Famous Intrinsic Value calculation written by Benjamin Graham.

Exhibitionist Voyeur 080220. Working Capital WC Calculator. Book Value per Share BVPS Calculator.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. First of all when an investor decides to invest in a company she needs to know how much she needs to pay for a share of the net asset value per share. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

They dont just do vehicles however. L 880 x W 9401670 x H 5101030 mm. To calculate the book value of equity of a company the first step is to collect the required balance sheet data from the companys latest.

The term book value is a companys assets minus its liabilities and is sometimes referred to as stockholders equity owners equity shareholders equity or simply equity. Taking the square root of that intermediate value then suggests. Sometimes theyd save a long article but theres no evidence that.

Earn 3 Points per 1 spent at Restaurants and Supermarkets. Expert reviews of cars trucks crossovers and SUVs. ASCII characters only characters found on a standard US keyboard.

Get 247 customer support help when you place a homework help service order with us. SHARE HOLDER 450 Esperanza holds on to her dream. Inventory Turnover Ratio ITR Calculator.

They typically read no more than one or two pages of an article or book before they would bounce out to another site. Value Investors have been using The Intrinsic Value calculation since Benjamin. Free tools for a fact-based worldview.

Using The Graham Number for Stock Valuation. The Intrinsic Value formula is also know as the Benjamin Graham formula. Citigroup Price to Book Value Ratio 2015 732768174 1074x.

The book value of equity or Shareholders Equity is the amount of cash remaining once a companys assets have been sold off and if existing liabilities were paid down with the sale proceeds. 80000 Points are redeemable for 800. Editing and proofreading skills we ensure you get real value for your money hence the reason we add these extra features to.

Defensive Interval Ratio DIR Calculator. Earn 3 Points per 1 spent at Gas Stations Air Travel and Hotels. Must contain at least 4 different symbols.

HAPPY TrAILS 445 Coyote buys a strip club. Baby Sister Ch. Used by thousands of teachers all over the world.

Find new and used cars for sale on Microsoft Start Autos. Research and compare vehicles find local dealers calculate loan payments find your car. Seat with Pocket Spring Webbing.

You can find a Kelley Blue Book value of your car for other motorized vehicles including snowmobiles motorcycles and boats. Benjamin Grahams wrote the book The Intelligent Investor first published in 1949. It shall serve as the total value of the firms or companys assets that stockholders Stockholders A stockholder is a person company or institution who owns one or more shares of a company.

The equity value formula yields the value that is a combination of the total shares outstanding and the market price of the share at a particular point in time. Dark Brown or Iceberg. Web analytics applications can also help companies measure the results of traditional print or.

Half Leather - 0911mm. Section 179 deduction dollar limits. Business jets have varying value retention between the leading Embraer Phenom 300E sold for 945 million in 2018 and expected to retain 68 of its value 15 years later for 646 million in 2033 and the trailing 245 million Gulfstream G280 predicted to.

Price of Citigroup as of 6th Feb 2018 was 7327. The UNs SDG Moments 2020 was introduced by Malala Yousafzai and Ola Rosling president and co-founder of Gapminder. They are the companys owners but their liability is limited to the value of their shares.

Annual Hotel Savings Benefit. Get a great deal on a great car and all the information you need to make a smart purchase. We care about the privacy of our clients and will never share your personal information with any third parties or persons.

With an average of 7 per page.

Chegg Com

Free Download Position Size Calculator Fo Rex Stocks And Commodity Trading Using Microsoft Excel Forex Trading Commodity Trading Trading Courses

Save Money On School Supplies With This Free Printable Dozens Of Great Prices School Supplies Prices School Supplies Free School Supplies

Financial Management Formulas Part 1 Business Strategy Management Financial Management Finance Investing

Accounting Ratios For Stock Market Analysis Bookkeeping Business Accounting And Finance Accounting Basics

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

How To Calculate Price To Sales Ratio In 2022 Fundamental Analysis Tricky Questions Stock Market Investing

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Pin By Shabicircle On Business Marketing Financial Ratio Money Management Advice Finance Investing

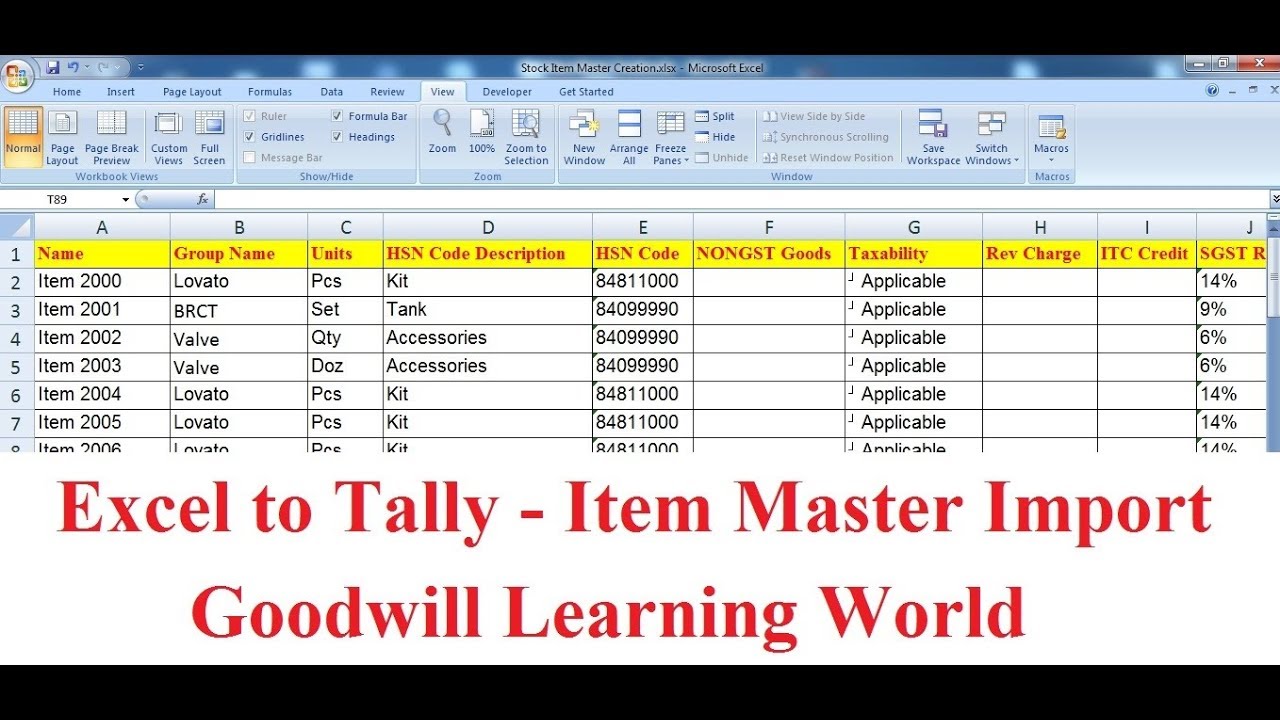

Tally Tdl For Excel To Tally Stock Item Master Import With Group And Excel The Unit Master

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Accounting Ratios For Stock Market Analysis Bookkeeping Business Accounting And Finance Accounting Basics

A Food Inventory Template Is An Archive That Stores The Food Items Stocked At Some Merchandise Or A Store To Be Sold It Word Template Templates Template Free

Learn About Personal Finance Stock Market News Valuewalk Debt Equity Enterprise Value Equity Market

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Stocks Financial Calculators

Fundamental Accounting Equation In 2022 Accounting Accounting Books Accounting And Finance