Calculate my income

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 180 4 45.

How To Calculate Gross Income Per Month

This calculator is always up to date and conforms to official Australian Tax Office rates and.

. First divide the daily pay by 4. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Enter your date of birth month day year format Enter earnings in the current year.

And is based on the tax brackets of 2021 and. When filling out your application youll be shown the expected yearly income. To put it numerically you will be charged with a 364 marginal tax rate and a 216 average tax rate in Maine.

Besides paying 11888 tax the government will also tax your employer because. Ad See the Paycheck Tools your competitors are already using - Start Now. Everyone works with a different amount of income during their retirement.

Income Calculator Explore and understand your investment options. If the amount shown is. Read reviews on the premier Paycheck Tools in the industry.

Factors to Help Calculate a Good Retirement Income for You. So with a daily rate of 180 your annual. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Federal withholdings This is the total amount withheld from your paychecks and applied. Instead of considering the weeks or months in a.

Use the average hours you work each week if your schedule varies. Our Resources Can Help You Decide Between Taxable Vs. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

You will be able to. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Write down the net expected income for coverage year or download and save the PDF.

Calculating gross income for businesses is a bit different. Gross income per month Hourly pay x Hours per week x 52 12. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

That means that your net pay will be 43041 per year or 3587 per month. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. We know your time is precious so.

Find out how many hours you work each week before calculating your annual income. Once you start using a good income tax calculator online you will realise its numerous benefits. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free.

Whether youre growing your investments or saving for retirement use our tools to get the confidence you need to reach. If you are earning a bonus payment one month enter the value of the bonus into the. Your taxable income is your adjusted gross income minus deductions standard or itemized.

It is mainly intended for residents of the US. Next take the result from step 1 and move the decimal point three places to the right. For instance if a.

People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle. Pay Your Income Tax Error-Free With An Online Income Tax Calculator. Next multiply the number of hours.

The total you end up working with. Financial Calculator has standalone keys for many financial calculations and functions making such calculations more direct than on standard calculators.

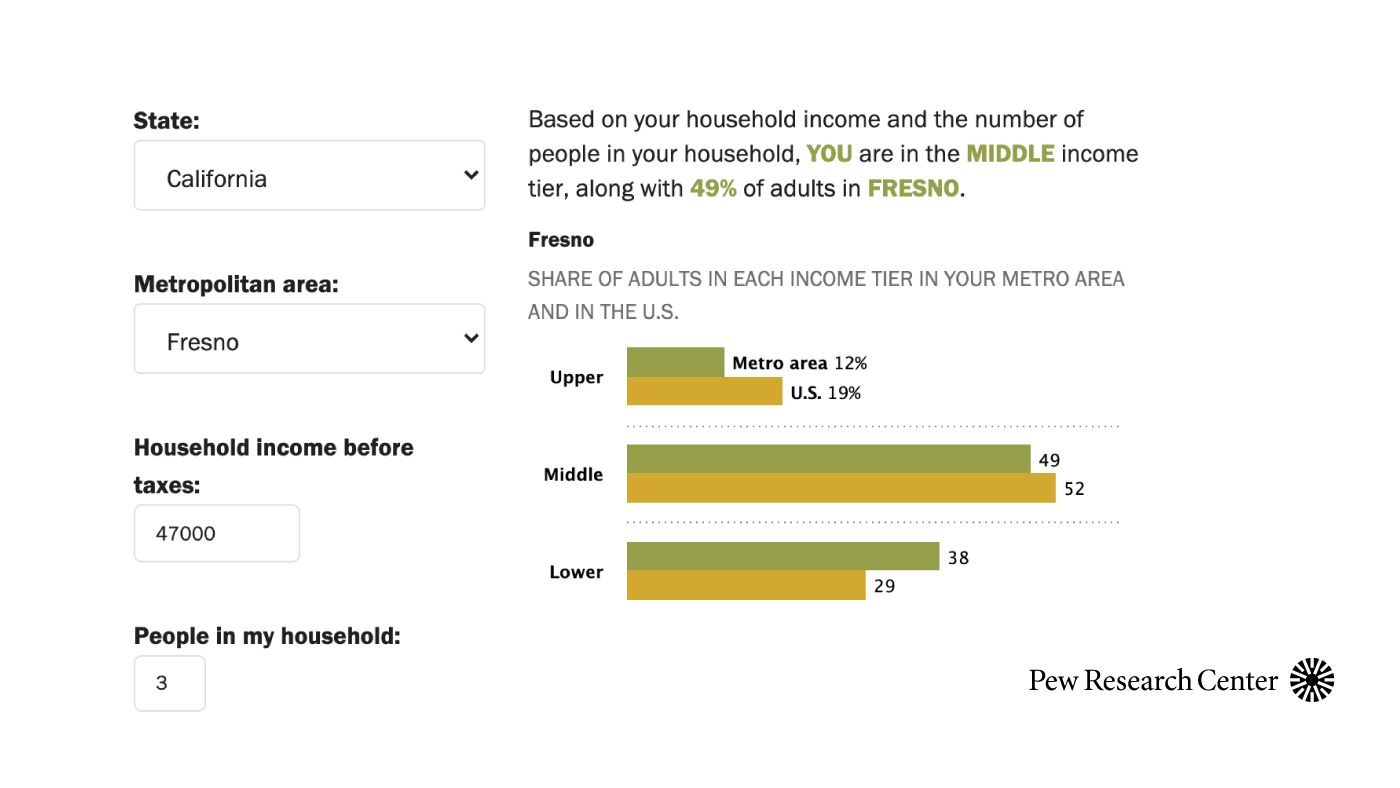

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

Salary Formula Calculate Salary Calculator Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Net Pay Step By Step Example

How To Calculate Taxable Income H R Block

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Agi Calculator Adjusted Gross Income Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Annual Income Calculator

4 Ways To Calculate Annual Salary Wikihow

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

3 Ways To Calculate Your Hourly Rate Wikihow

Income Percentile Calculator For The United States

Taxable Income Formula Examples How To Calculate Taxable Income

Net Worth Calculator Find Your Net Worth Nerdwallet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor