Gross earnings calculator

With five working days in a week this means that you are working 40 hours per week. Use this federal gross pay calculator to gross up wages based on net pay.

Sales Tax Calculator

Or Select a state.

. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. This calculator helps you determine the gross paycheck needed to provide a required net amount. Two Simple StepsStep 1.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Use this tool to. This places Ireland on the 8th place in the International.

That means that your net pay will be 37957 per year or 3163 per month. A pay period can be weekly fortnightly or monthly. All other pay frequency inputs are assumed to.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. How It Works. Gross pay is the amount of pay an employee earns before any taxes and deductions are taken out while net pay is the amount an employee.

Try out the take-home calculator choose the 202223 tax year and see how it affects. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Difference between gross pay and net pay.

To stop the auto-calculation you will need to delete. For example if an employee receives 500 in take-home pay this calculator can be used to. The PAYE Calculator will auto calculate your saved Main gross salary.

You can change the calculation by saving a new Main income. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Using the annual income formula the calculation would be.

Annual Income 15hour x 40 hoursweek x. But calculating your weekly take-home. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period.

How Your Paycheck Works. Figure out Gross ProfitResale - Cost Gross Profit12 resale - 7 cost 5 Gross ProfitStep 2. Your taxcode if you know it.

See how your refund take-home pay or tax due are affected by withholding amount. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Student loan plan if relevant.

Wages salary commissions bonuses vacation pay or anything an employer pays an employee for personal services. Estimate your federal income tax withholding. Required net monthly pay.

Divide Gross Profit by Resaleand multiply times 100 to get the. Then enter your current payroll information and. First enter the net paycheck you require.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. It can be used for the. To use the net to gross calculator you will be required to provide the following information.

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

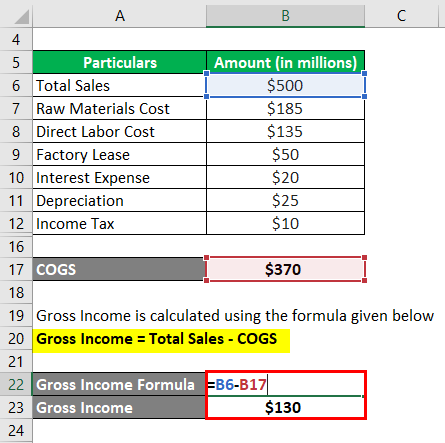

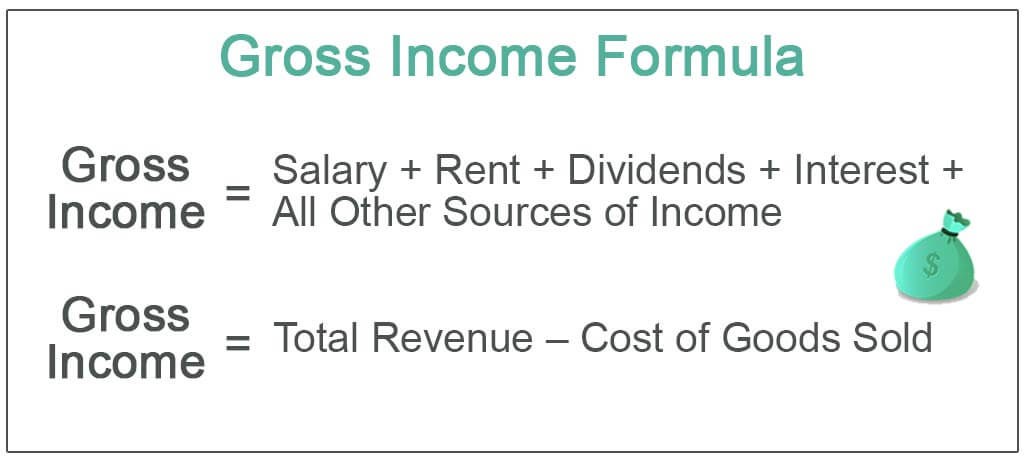

Gross Income Formula Step By Step Calculations

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Income Formula Step By Step Calculations

Gross Income Formula Calculator Examples With Excel Template

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Gross Pay Youtube

4 Ways To Calculate Annual Salary Wikihow

Net To Gross Calculator

Gross Income Formula Step By Step Calculations

Gross Income Formula Calculator Examples With Excel Template

Gross Income Formula Step By Step Calculations

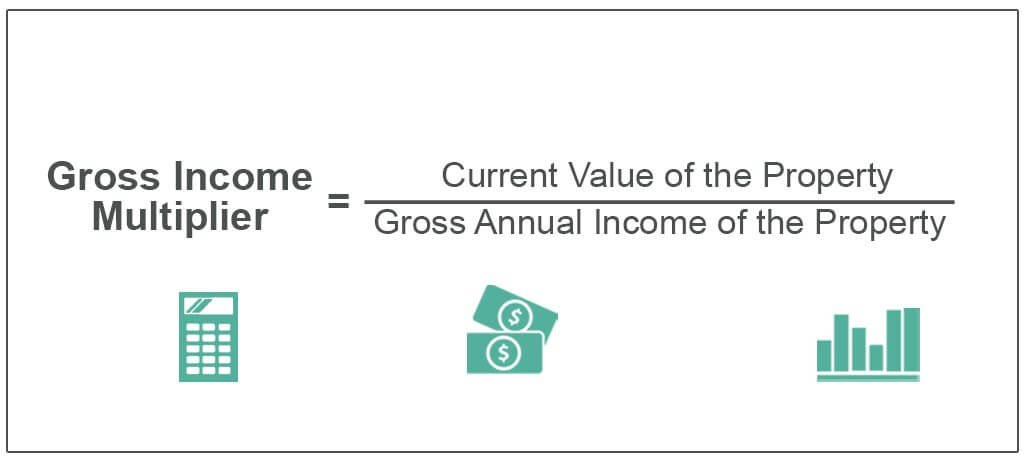

Gross Income Multiplier How To Calculate Gross Income Multiplier

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Gross Income Formula Calculator Examples With Excel Template

How To Calculate Gross Income Per Month

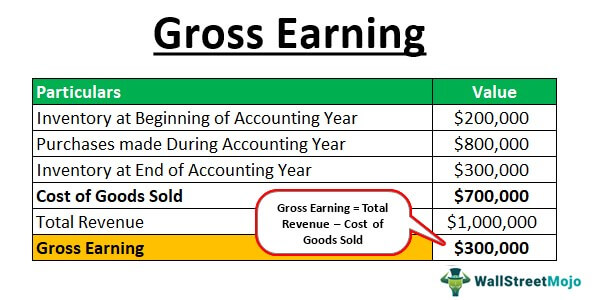

Gross Earning Meaning How To Calculate Gross Earning